Life Insurance in and around Charlotte

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

It can be a big deal to provide for your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your loved ones can maintain a current standard of living and/or pay for college as they grieve your loss.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Put Those Worries To Rest

And State Farm Agent Tim Good is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific time frame. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

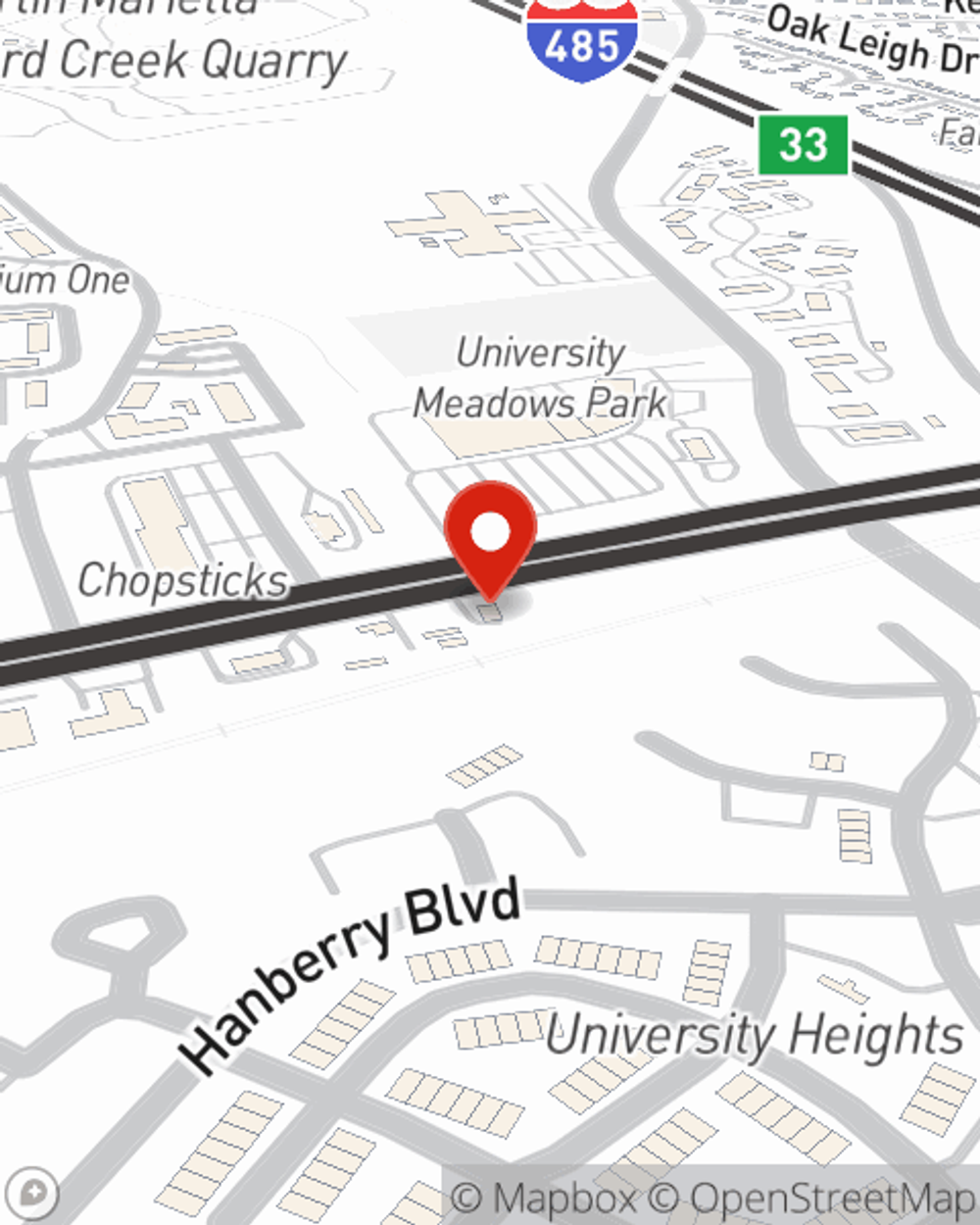

Interested in experiencing what State Farm can do for you? Reach out to agent Tim Good today to get to know your personalized Life insurance options.

Have More Questions About Life Insurance?

Call Tim at (704) 548-3636 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.